-

Články

Top novinky

Reklama- Vzdělávání

- Časopisy

Top články

Nové číslo

- Témata

Top novinky

Reklama- Videa

- Podcasty

Nové podcasty

Reklama- Kariéra

Doporučené pozice

Reklama- Praxe

Top novinky

ReklamaGlobal Health Philanthropy and Institutional Relationships: How Should Conflicts of Interest Be Addressed?

article has not abstract

Published in the journal: . PLoS Med 8(4): e32767. doi:10.1371/journal.pmed.1001020

Category: Policy Forum

doi: https://doi.org/10.1371/journal.pmed.1001020Summary

article has not abstract

Summary Points

-

Institutional relationships in global health are a growing area of study, but few if any previous analyses have examined private foundations.

-

Tax-exempt private foundations and for-profit corporations have increasingly engaged in relationships that can influence global health.

-

Using a case study of five of the largest private global health foundations, we identify the scope of relationships between tax-exempt foundations and for-profit corporations.

-

Many public health foundations have associations with private food and pharmaceutical corporations. In some instances, these corporations directly benefit from foundation grants, and foundations in turn are invested in the corporations to which they award these grants.

-

Personnel move between food and drug industries and public health foundations. Foundation board members and decision-makers also sit on the boards of some for-profit corporations benefitting from their grants.

-

While private foundations adopt standard disclosure protocols for employees to mitigate potential conflicts of interests, these do not always apply to the overall endowment investments of the foundations or to board membership appointments. The extent and range of relationships between tax-exempt foundations and for-profit corporations suggest that transparency or grant-making recusal of employees alone may not be preventing potential conflicts of interests between global health programs and their financing.

Institutional Relationships and Global Health

The institutional relationships that exist in global health are a growing area of inquiry. This has been most evident in work examining corporate involvement in health, because tensions can arise between the profit motives of corporations and the promotion of public health. Whereas corporations make products that can improve health (such as pharmaceuticals and vaccines) and relationships between public health institutions and for-profit corporations can be seen as positive opportunities for corporations to improve public health [1], corporations also make products that damage health (such as tobacco or unhealthy foods). And because some corporations have a vested interest in the activities of public health bodies, there have been documented attempts to influence the public health agenda by establishing associations with health care institutions [2].

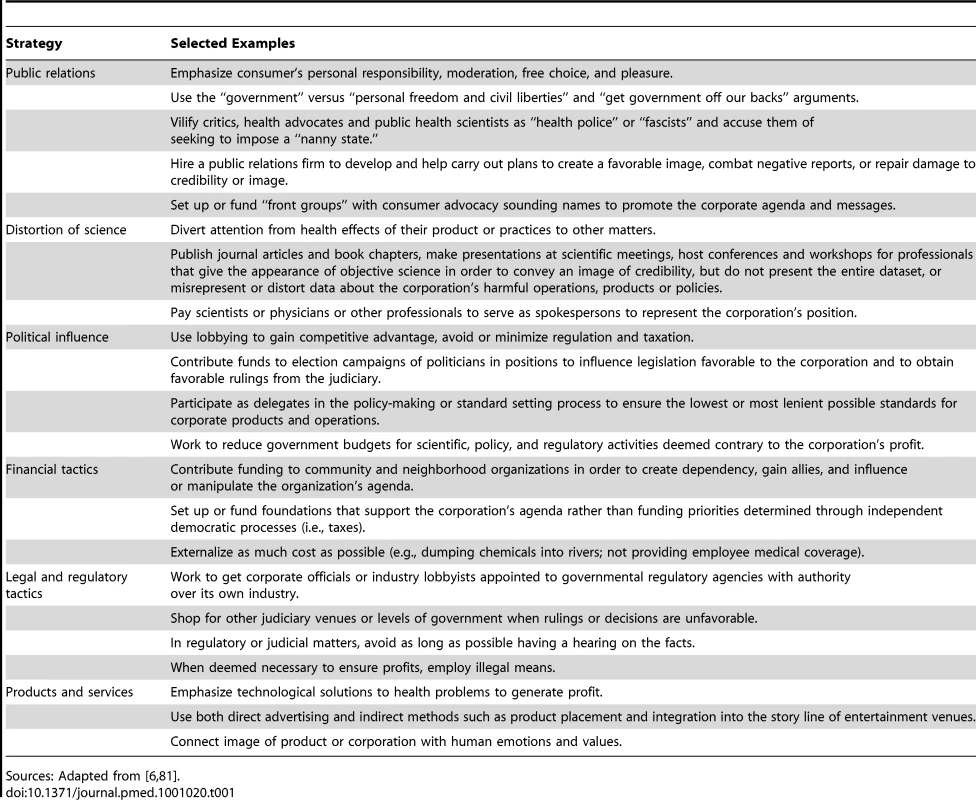

The relationships of concern between for-profit institutions and health-related organizations can involve direct financing—such as when pharmaceutical companies give gifts to physicians in a manner that has been shown to increase prescribing of the promoted drugs [3],[4]—or indirect relationship-building, such as when corporate staff or paid consultants act as board members or strategic advisors to health organizations. There are many documented examples of corporate tactics by the tobacco, mining, alcohol, asbestos, food, and petrochemical industries aimed at influencing public health promotion (Table 1) [5]–[7].

Tab. 1.

Sources: Adapted from <em class="ref">[6]</em>,<em class="ref">[81]</em>. In addition to examining corporate relationships in the health arena, public health advocates have also expressed concerns about whether potential conflicts of interests among state development aid programs could negatively affect health outcomes. Many government development agencies act explicitly in the interests of their own country [8]–[13]. This has taken the form of conditionalities on development aid and when aid is linked to other political agendas such as reduced tariffs or privatizing state-owned assets [14],[15]. Government aid has also been criticized for causing unintended health consequences—for example, by distorting recipient government health budgets by focusing on one or a few diseases at the expense of others [16], by creating a misalignment between health funding and the observed burden of disease due to external donations [17], and by inappropriately displacing government funds that would have otherwise been invested in health [18].

Institutional Conflicts of Interests

When the agendas of institutions working in global health coincide, relationships can bring health benefits. But where agendas differ, a conflict of interest may arise. Sometimes termed “competing interests,” conflicts of interest have varying definitions. The strict, legal meaning of “conflicts of interest” under US law is a situation in which there is “a real or seeming incompatibility between one's private interests and one's public or fiduciary duties” [19]. In more popular usage, as set out in Wikipedia, it is defined as when “an individual or organization is involved in multiple interests, one of which could possibly corrupt the motivation for an act in the other [italics in original]” [20]. Disclosure is an essential first step in dealing with such potential conflicts [21], but in some cases these are fundamentally irreconcilable even with disclosure. It can also be difficult to ascertain when disclosure is only partial, as evidenced by tobacco litigation that provided examples of how it is possible to disclose some truth, but not the whole truth, when it came to declarations of conflicts of interest [22]. Thus, the World Health Organization (WHO) defines a potential conflict of interest more broadly, as in its guidelines for the Roll Back Malaria (RBM) program:

A conflict of interest can occur when a Partner's ability to exercise judgment in one role is impaired by his or her obligations in another role or by the existence of competing interests. Such situations create a risk of a tendency towards bias in favor of one interest over another or that the individual would not fulfill his or her duties impartially and in the best interest of the RBM Partnership.

A conflict of interest may exist even if no unethical or improper act results from it. It can create an appearance of impropriety that can undermine confidence in the individual, his/her constituency or organization. Both actual and perceived conflicts of interest can undermine the reputation and work of the Partnership. [23]

Global Health Foundations and Potential Conflicts of Interest

While corporate involvement in and government aid for health has been extensively analyzed and critiqued in the public health literature, less attention has been paid to the impact of private donors on public health [24]. Over the past decade, the bulk of new health aid designed to reach the Millennium Development Goals has come from individuals and corporations [25],[26]. The influence of this private philanthropy on global health is profound and transformative [27].

Yet, it is intuitive that those who donate money have a set of goals and objectives that are of interest to them in making such donations. Although the philanthropic activities of wealthy individuals and corporations have attracted controversy in the past (Text S1), their charitable mission often means that they face less scrutiny than governments; critical analysis of foundations can be seen as “biting the hand that feeds us.” As a result, within the global health community, private donors are sometimes viewed as the “third rail” that no one wishes to analyze. However, by virtue of not being subject to popular elections, private foundations operate outside the typical boundaries of democracy; unlike government ministries, private foundations cannot be influenced in the same way by the communities affected by the foundations' actions. In the interests of public health, and particularly because poor communities affected by foundations do not automatically have a feedback mechanism to influence the decisions of private funders, we argue that it is appropriate to subject private foundations to the same scrutiny received by public institutions.

In this paper, we examine the scope of potential conflicts of interests that exist among the private foundations that are major funders of global health. We use the WHO definition of potential conflicts of interest, as detailed above. We conducted a case study using data about the networks, activities, and funding patterns of the Bill & Melinda Gates Foundation, Ford Foundation, W. K. Kellogg Foundation, Robert Wood Johnson Foundation, and Rockefeller Foundation, because these are the largest private global health foundations. We include an examination of both the potential conflicts that may arise in relation to these foundations' overall activities and those of their individual employees, which are already typically covered by the foundations' conflict of interest policies. We show that, taken together, these conflicts of interest can create complex situations whose potential effects may be difficult to assess in isolation.

Before proceeding with the findings of our analysis, we first review the governance and regulations of private nonprofit foundations.

Rules and Regulations Governing Private Nonprofit Foundations

Nongovernmental, nonprofit organizations operate under different rules and regulations in each country. In the United States' common law system, private foundations must qualify for federal tax exemption. Unlike public charities, they usually do not provide services directly, but instead make grants to other entities to fulfill the foundation's mission. Text S2 provides detailed information about the rules and regulations governing private foundations in the US; most notably, private foundations must not operate in a manner that benefits private interests, particularly because their tax exemption implies that their work justifies forgoing the redistribution of tax dollars from their private accounts to public programs.

Private foundations may receive most of their funds from a parent for-profit corporation (such as PepsiCo Foundation) or wealthy individuals and families (such as the Doris Duke Foundation), sometimes in the form of investments (gifts of stock) and cash endowments. Historically some foundations have maintained separation between management of their endowments and grantmaking decisions [28], although these practices and the degree of separation vary across foundations. Some foundations, like the Ford Foundation, have investment committees composed of members of the board of directors. Others may manage foundation investments externally or as a collaboration of professional investment teams with members of the board. In most cases, the board of directors is responsible for overseeing that funding decisions are made according to a set of foundation grant-making criteria. Again, practices vary across foundations, as some have governance committees, but typically these criteria are set by the founders (in some cases including the parent company) and/or executive committee members, donors, and overall boards of directors of the foundations.

Despite the existence of policies explicitly designed to mitigate potential conflicts of interest, the boundaries between foundations, their investments, and their parent corporations or private funders can become blurred. Often, directors of the boards of foundations also sit on the board of private corporations, adopting multiple roles. Thus, the Hilton Foundation has “an independent Board of Trustees and Grants Committee comprised of independent as well as senior Hilton personnel. The Board of Trustees includes independent members and Hilton members nominated by the business” [29]. Although practices vary across foundations, typically the chief executive officer (CEO) of the parent corporation appoints the executives to the private foundation and has official authority to influence funding decisions through serving on the foundation board [30]. However, while acting as a member of the corporation's board, the CEO, as well as any other member of a corporate board, has a legally binding fiduciary duty to maximize shareholder profits for the corporation. For this reason, until 1953, US law prohibited companies from donating money to causes from which they did not directly benefit [30].

To understand whether measures currently employed to prevent potential conflicts of interest among private foundations are sufficient to prevent an adverse impact on public health, it is first necessary to evaluate the scope of these potential conflicts. Previous analyses of corporate boards using power structure methods have studied corporate philanthropy and economic development organizations [30],[31],[32],[33], but to our knowledge such analyses have yet to be applied to the area of public health [24],[27]. Here, we apply these methods for the first time to study major private funders of global health programs.

Data and Methods

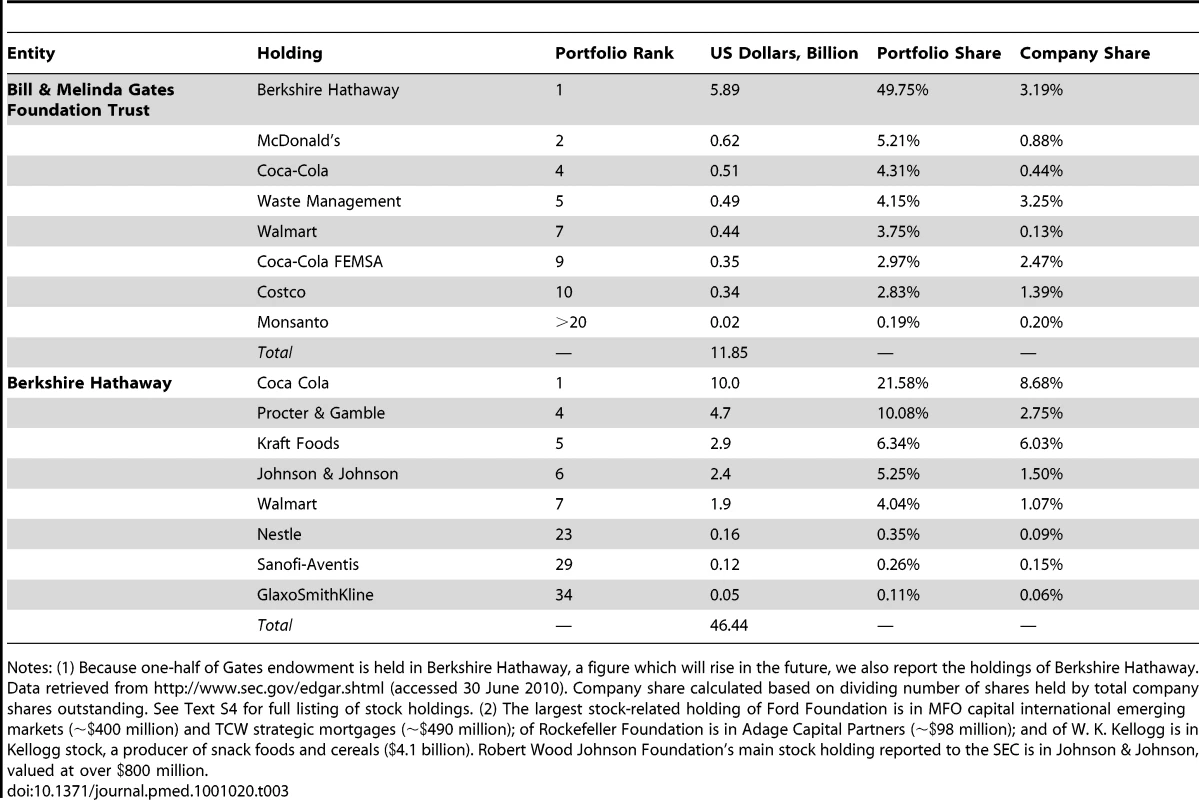

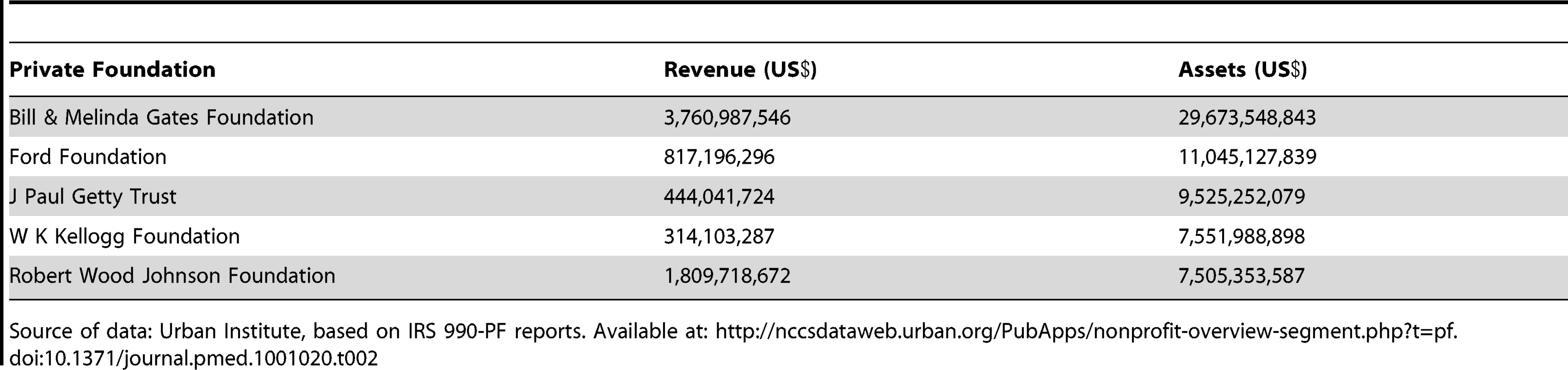

There are more than 100,000 private nonprofit foundations operating in the US, many of which contribute to global health activities and research (holding about US$569 billion in assets). Table 2 lists the top US-based private foundations. Of these, we chose the Bill & Melinda Gates Foundation as a focus for detailed case-study because it is the largest private philanthropy in global health, with financing greater than the budget of the entire WHO. For comparison, we chose the next three wealthiest US private grant-making foundations contributing to global health funding: the Ford Foundation, the W. K. Kellogg Foundation, and the Robert Wood Johnson Foundation. Given the historical importance of the Rockefeller Foundation in global health, we also included it as a fifth comparator. While our analysis is limited to these five foundations, the methods applied here can be extended to any other foundations and their institutional affiliates. Our intention is to provide an illustrative case study for initial analysis of this subject.

Tab. 2. Top five private foundations in the US, 2008.

In the sociology and political science literature, aid organizations have typically been studied by examining at least three sets of observable questions about power and financial relationships, with the intent of “following the money” [33]–[39]: (i) Where does money come from and with what conditions?; (ii) Who decides? Who sits on the board of directors, and what are their histories, relationships, and interests?; and (iii) Who benefits from these decisions? Where are these funds distributed and which entities derive income from that expenditure? Related to decision-making and control of the agenda, notions of “soft power”[40] and Lukes' third dimension of power [41] emphasize the importance of power expressed not only through concrete, observable decisions and financial flows but also in hidden and more subtle, yet powerful, influences such as through shaping perceptions, cognition, and preferences, and influencing what is “kept out” of agendas. This dimension of power is arguably the most powerful; it is ideological in nature and addresses how decisions are made by the foundation about what issues are funded and how (e.g., the foundation will fund child health but not HIV, or will fund programs in Africa but not in Asia), and the cultural influence of funders on the overall field to which the philanthropy is being directed (e.g., emphasizing individual rather than collective responsibility, or focusing on technological interventions rather than indigenous capacity building). However, this dimension of power is also more difficult to observe, as it is indirect, informal, and may not be made explicit [41],[42]. Text S3 further describes our sources of data used to evaluate each component, including endowment disclosures with the US Internal Revenue Service and stock holdings with the US Securities and Exchange Commission (SEC).

Comparative Analysis of Leading US Global Health Foundations

Where Does the Money Come From?

The Bill & Melinda Gates Foundation's endowment mainly comes from Bill Gates' personal fortune and stock in Berkshire Hathaway given to the Foundation as a gift from Hathaway's CEO Warren Buffett. In 2006, Buffett made a pledge to gradually give away all of his Berkshire Hathaway stock to the Bill & Melinda Gates Foundation, most recently with an additional 24.7 million shares in July 2010 [43]. Currently, the Bill & Melinda Gates Foundation is listed with the SEC as a 10% owner of the Berkshire company [44].

At the end of 2008, the Bill & Melinda Gates Foundation Trust had US$29.6 billion assets under its management: $13.5 billion were in corporate stock, $1.8 billion in corporate bonds, $6.1 billion in US and state government obligations, and $8.2 billion in other investments, land, and temporary holdings [45].

As shown in Table 3, the Bill & Melinda Gates Foundation's corporate stock endowment is heavily invested in food and pharmaceutical companies, directly and indirectly (see Text S4 for full listings). The Foundation holds significant shares in McDonald's (9.4 million shares representing about 5% of the Gates' portfolio), and Coca-Cola (>15 million shares, over 7% of the Foundation's portfolio, not counting Berkshire Hathaway holdings). In 2009 the Bill & Melinda Gates Foundation sold extensive pharmaceutical holdings in Johnson & Johnson (2.5 million shares), Schering-Plough Corporation (14.9 million shares), Eli Lilly and Company (about 1 million shares), Merck & Co. (8.1 million shares), and Wyeth (3.7 million shares) [46].

About half of the Bill & Melinda Gates Foundation's stock holdings are already invested in Berkshire Hathaway, a conglomerate holding company owning several subsidiary companies, including banks, railroads, candy production, retail, and utilities. Thus, it is necessary to examine the holdings of the Berkshire company to analyze the Foundation's stock holdings. Berkshire Hathaway's largest investment is in Coca-Cola. It owns an additional 8.7% of Coca-Cola (Warren Buffett's firm is the largest shareholder in Coca-Cola, having stock worth >$10 billion dollars) and 6.3% of Kraft (Buffett is also the largest shareholder of Kraft) [47]. Berkshire Hathaway also has significant ownership in GlaxoSmithKline, Sanofi-Aventis, Johnson & Johnson, and Procter & Gamble, and is one of the main global investors in the latter two pharmaceutical companies. Since Buffett is gradually transferring ownership of Berkshire Hathaway stock to the Bill & Melinda Gates Foundation [48], the Foundation will soon be the largest stakeholder of Coca-Cola and Kraft in the world.

Endowment investments in pharmaceutical and food companies were similarly observed among the Ford, Rockefeller, W. K. Kellogg Foundation, and Robert Wood Johnson Foundations [44],[49]–[53]. The invested companies included, to name a few, Coca-Cola, Kellogg (a leading producer of snacks and breakfast foods and the main investment of Kellogg Foundation), PepsiCo, Pfizer, GlaxoSmithKline, McDonald's, Nestle (a company with 6,000 brands mainly in food and beverage including coffee, water, chocolate, confectionery, ice cream, “health-care nutrition”, and frozen foods, among others); NovoNordisk, YumBrands (the world's largest restaurant company, operating Pizza Hut, KFC [Kentucky Fried Chicken], and Taco Bell, among others), Johnson & Johnson (main investment of Robert Wood Johnson Foundation), and Sanofi-Aventis, in addition to several mining, petrochemical, and alcohol companies. Additionally, the Ford Foundation had holdings in the tobacco company Lorillard [44], while W.K. Kellogg and Rockefeller foundations were indirectly invested in tobacco corporations through conglomerate equity funds such as Cedar Rock Capital and Adage Capital Partners, respectively. However, foundations may have guidelines to align their investment portfolio with their programmatic mission, such as the Rockefeller Foundation's “Social Investing Guidelines” [54].

Bill and Melinda Gates, according to their own statements, guide the managers of the Foundation's endowment, Cascade Investment LLC (a private investment and holding company controlled by Bill Gates holding a 20% stake in Coca-Cola FEMSA, a Coca-Cola bottling company, in 2008 and a large stake in FEMSA, the main bottling company of alcoholic and soft drinks, especially in Mexico), and regularly assess the endowment's holdings. As noted by the Foundation's description of management practices, “When instructing the investment managers, Bill and Melinda also consider other issues beyond corporate profits, including the values that drive the foundation's work. They have defined areas in which the endowment will not invest, such as companies whose profit model is centrally tied to corporate activity that they find egregious. This is why the endowment does not invest in tobacco stocks.” The Foundation had invested in Philip Morris bonds prior to a New York Times report on the matter in the year 2000 [28].

The Bill & Melinda Gates Foundation conflict of interest policy also sets out guidelines for employees with stockholdings [55], recognizing that “Holding a financial interest in an organization does not necessarily create a conflict of interest. It will depend upon the facts and your role as a foundation employee in selecting the entity for the proposed transaction” and, in particular, the policy states that “holding a financial interest in Berkshire Hathaway or Microsoft does not necessarily create a conflict of interest and there is no need to disclose this information”.

Who Decides?

The Ford Foundation has a mission statement to “reduce poverty and injustice, strengthen democratic values, promote international cooperation, and advance human achievement” [56]. The Rockefeller Foundation also adopts a statement of purpose, which on its founding specified “To promote the well-being of mankind throughout the world,” and currently states “Today we apply this mission in the era of globalization” [57]. Finally, the Bill & Melinda Gates Foundation has no mission statement but has 15 guiding principles (the first is that it is “driven by the interests and passions of the Gates family”). Mr. Gates also writes an annual letter, setting out the Foundation's agenda; the most recent states that “overall we have about 30 innovations we are backing. Although the list includes only one new vaccine and one new seed, we are funding vaccines for several diseases (malaria, AIDS, tuberculosis, etc.) and new seeds for many crops (corn, rice, wheat, sorghum, etc.) …A few things we do, like disaster relief and scholarships do not fit this model, but over 90% of our work does” [58].

Like the other private foundations, the Bill & Melinda Gates Foundation does not disclose the detailed discussions that take place among its Board when funding decisions are made, because of the need to ensure free comment on grant applications. However, the Foundation's detailed policy on potential conflicts of interest for its employees [55] states that an employee has a potential conflict of interest when “He or she or any member of his or her family may receive a financial or other significant benefit as a result of the individual's position at the foundation; The individual has the opportunity to influence the foundation's granting, business, administrative, or other material decisions in a manner that leads to personal gain or advantage; or The individual has an existing or potential financial or other significant interest which impairs or might appear to impair the individual's independence in the discharge of their responsibilities to the foundation.”

The Bill & Melinda Gates Foundation's management committee oversees all the Foundation's efforts (analogous to a board of directors). The management committee comprises three co-chairs (Bill Gates, Melinda Gates, and William Gates Sr.); three trustees (Bill and Melinda Gates and Warren Buffett); a CEO (Jeff Raikes); three presidents of its respective programs in Global Development (Sylvia Mathews Burwell), United States (Allan Golston), Global Health (Tachi Yamada); chief administrative (Martha Choe), financial (Richard Henriques), human resources (Franci Phelan), and communications officers (Kate James); a managing director of public policy (Geoff Lamb); and a general counsel and secretary leading the legal team (Connie Collingsworth). Each program has a leadership team, such as the Global Health Leadership team, led by the president of the program.

Several of the Foundation's members of the management committee, leadership teams, affiliates, and major funders are currently or were previously members of the boards or executive branches of several major food and pharmaceutical companies (see the commercial network of the Bill & Melinda Gates Foundation in the interactive map tool at http://mapper.nndb.com/start/?map=12051; see also Figure S1 for more details), including Coca-Cola, Merck, Novartis, General Mills, Kraft, and Unilever (one of the largest global consumer goods companies owning product brands in food, beverage, and personal and home care), among others [59]–[62].

Given the important role of these board members in shaping and approving grant allocation decisions as well as the Foundation's strategic vision, the personal histories of leading members of the board were analyzed. The Foundation is described as “led by CEO Jeff Raikes and Co-chair William H. Gates Sr., under the direction of Bill and Melinda Gates and Warren Buffett.” Warren Buffett, the second-largest donor to the Foundation and a board member, was a member of the board of Coca-Cola from 1989–2006 (Figure S1; his son, Howard Buffett, is on the board of Coca-Cola Enterprises and ConAgra Foods [one of North America's largest packaged food companies], which is invested in modern seed technology, as are other members of the board of Berkshire Hathaway). Warren Buffett is the chairman and CEO of Berkshire Hathaway (and Bill Gates is a director on its board). Jeff Raikes, who replaced Patty Stonesifer in May 2008 (currently a senior advisor to the trustees), retired as the president of Microsoft business division to join the Foundation. Both Raikes and William Gates Sr. are on the board of Costco Wholesale Corporation (a membership warehouse club, selling bulk-packaged products at very high volume and low prices—the third largest retailer in the US).

Further overlaps between Bill & Melinda Gates Foundation leadership, other private foundations, and circular flows of personnel with food and pharmaceutical companies were observed (Text S5). Such patterns of interlinked board directorships, common among corporations and nonprofit organizations, were similarly found in the other private foundations studied.

The Gates Foundation conflict of interest policy (as mentioned above) [55] notes that in such cases of overlap, the employee should disclose his/her position; refrain from exercising decision-making authority with respect to the grant and also with helping the potential grantee with preparing or submitting proposals; and recuse oneself from managing the grant. Further, it notes that board members of other organizations have fiduciary duties of care, loyalty, and confidentiality to those organizations, which require directors to act in accordance with the best interest of the organization on whose board the director serves, irrespective of the other entities with which the director is affiliated. Where recusal is not possible, the policy states that “you should document that your manager at the foundation has approved any final decisions with respect to the foundation's grant to the organization.”

Who Benefits? Where Does the Money Go?

The bulk of the Bill & Melinda Gates Foundation's financial transfers in global health have been to programs developing medical technologies [24]: more than 97% of its financial disbursements are directed to infectious diseases, and less than 3% to chronic noncommunicable diseases [16]. The majority of the Foundation's grants are directed to researchers in the US. Of US$9 billion in financial transactions that went toward 1,094 global health programs between 1998 and 2007, about half went to recipients in the US and 40% to supranational organisations; overall, about 42% of all funding was spent on health care delivery or increasing access to drugs, vaccines, and medical commodities, while an additional one-third was allocated to technology development (mainly for vaccines and microbicides) or basic science research [24].

Several grants are linked to companies that are represented on the Foundation's board among its investments. The Foundation has established partnerships with the Coca-Cola Company, which, in the words of the Foundation, are intended to “create new market opportunities for local farmers whose fruit will be used for Coca-Cola's locally-produced and sold fruit juices” [63]. The program is a four-year, $11.5 million partnership for “mango and passion fruit farmers to participate in Coca-Cola's supply chain for the first time,” with a $7.5 million grant provided by the Bill & Melinda Gates Foundation to TechnoServe, $3 million provided by The Coca-Cola Company, and $1 million by bottling partner Coca-Cola Sabco. This could reflect the recent comments of Melinda Gates in a webcast, “What we can learn from Coke,” suggesting that government agencies and nongovernmental organizations (NGOs) could learn from the manufacturer to promote global health in low - and middle-income countries [64].

In addition, many of the Foundation's pharmaceutical development grants may benefit leading pharmaceutical companies such as Merck and GlaxoSmithKline [24], for example via partnerships to test pneumonia and rotavirus vaccines (such as the ROTATEQ partnership and the Merck Vaccines network partnership with the Global Alliance for Vaccines and Immunizations network), experimental malaria vaccines (through Medicines for Malaria Venture, an NGO), cervical cancer vaccines (through PATH, an NGO, and Merck's vaccine Gardasil), and HIV interventions (through the Africa Comprehensive HIV/AIDS partnership). Johnson & Johnson has entered a clinical partnership to develop new HIV-prevention technology, noting “the work between Johnson & Johnson and the Gates Foundation is a strong, strategic, comprehensive relationship” [65].

The Foundation has also funded initiatives that are not obviously linked to corporations, such as those for health surveillance and monitoring of disease burdens. It invested $105 million to create the Institute for Health Metrics and Evaluation at the University of Washington, which is led by one of the leading researchers responsible for the Global Burden of Disease Study (one of the most widely used datasets in global health) and has now become a leading institution for estimating global mortality and disability rates. The Foundation is also one of the largest donors to the WHO, giving sums that amount to about 4% of WHO's overall budget (∼$150 million) [17].

Discussion

Here, we have observed that five major US private nonprofit foundations have significant investments in food and/or pharmaceutical companies, directors who currently or have previously sat on the boards of those companies, and, in several cases, enter in partnerships with those companies. Our analysis focused mainly on the potential conflicts of interests among the largest foundation, the Bill & Melinda Gates Foundation. As one example, we found that Bill & Melinda Gates Foundation has substantial holdings in the Coca-Cola Corporation, and also participates in grants that encourage communities in developing countries to become business affiliates of Coca-Cola. It has been noted by some commentators that sugary drinks such as those produced by Coca-Cola are correlated with the rapid increase in obesity and diabetes in developing countries [66]. Noncommunicable diseases constitute more than half of all deaths in low - and middle-income countries [67], while the Bill & Melinda Gates Foundation, along with the World Bank and national official development aid donors, have been criticized for directing less than 3% of their collective budgets toward these conditions [16],[24],[68]. Similar potential conflicts of interests were observed among other leading global health nonprofit foundations, including the Ford Foundation, Rockefeller Foundation, Robert Wood Johnson Foundation, and W.K. Kellogg Foundation.

Before assessing the implications of these findings, important limitations of our study must be addressed. First, as with all studies into the sociology of institutions [37],[39], we can observe the flows of funding and interlocking members of different institutions, but we cannot assess whether these associations resulted in a particular decision taking place. At a minimum, our observations indicate that some of the same people who participate on the boards of major multinational pharmaceutical and food corporations are also linked to the managerial boards of the Bill & Melinda Gates Foundation. Second, the situation changes rapidly as, in the case of investment holdings, the information provided is already dated at the time of this communication given daily changes in stock portfolios. Third, mapping the institutional relationships between representatives of boards of directors and their other affiliations is a complex task and, to our knowledge, no standardized dataset exists for this purpose. Thus, it is possible that the links we demonstrate in Figure S1 are not exhaustive and that several links we report pre-date the year 2008. Fourth, we have focused our attention on private foundations given the dearth of prior academic analyses in this realm. However, nonprofit organizations and universities have also been accused of bias against the private sector, with ideologically driven critiques and financial connections that favor government-based bureaucracies (although corporate leaders sit on the boards of major US universities) [69]. Similarly, influence is not unidirectional from corporations to nonprofit bodies; the latter can influence corporations in the many modes of “corporate philanthropy” and social responsibility. Hence, our focus of analysis on private institutions does not provide a comprehensive review of the types of interactions and interests that can exist in the global health sphere. Finally, our analysis has also not addressed the potential for conflicts of interest to arise with the Bill & Melinda Gates Foundation's grants related to the agricultural sector and investments in seed technologies, pesticides, and genetically modified organisms in connection with Monsanto (in which the Foundation holds stock and with which it supports joint grants through the African Agricultural Technology Foundation that may benefit the company) as well as the Foundation's stock holdings in oil companies, such as ExxonMobil and British Petroleum, that have been linked to environmental and health crises in the Niger Delta and other regions [70].

A private foundation clearly has the legal right to spend money however it wishes within the limits of the law; yet, in an environment where private foundations influence the future direction of, for example, what programs will be introduced into a foreign community, in a manner that does not necessarily involve directorship or voting from the community members themselves, it is reasonable to subject the decision-making processes of these entities to public debate, especially if these funds were to have otherwise been collected for public redistribution through federal taxation.

Several strategies may help mitigate the potential for conflicts of interests in private foundations to negatively impact global health decision-making (also Box 1):

Box 1. Strategies for Mitigating Conflicts of Interest

1. Divestment: Investments should not counteract the foundation's charitable mission statement and objectives in either a real or a perceived way. There should be separation between investment management and the foundation's board. It is also possible to create a “blind trust” so that the foundation leaders are not aware of their corporate investments and avoids the possibility that investment knowledge influences program decisions.

2. Transparency: Full disclosure of actual or potential conflicts of interest is necessary in making public health decisions. This includes disclosing corporate affiliations (directorships, advisory panels, funding receipt) and personal investment holdings. When board members and their friends and relatives stand to be directly affected by grant decisions, they should recuse themselves from the discussion and decision. Members may also resign from corporate boards and sell stock (or create a blind trust, as described above). Independent audits can also routinely monitor the scope and management of potential conflicts of interest within private foundations. A widely shared and monitored public health code of ethics could provide guidance to mitigate conflicts of interest at foundations from adversely influencing practice.

3. Alignment of aid with community needs: Foundation investment and program portfolios should incorporate representation from the intended recipients of its support.

(1) Divestment

Private foundations have been advised to not invest in companies that stand to profit from the tax-exempt foundation's agenda or in those that produce products such as tobacco, salty foods, or sugary drinks that have well-established connections to global health epidemics [71]. Such investments may counter these foundations' purposes of promoting global health. Similarly, foundations must be wary about investing in pharmaceutical and food and beverage companies that could gain market share and enhanced publicity, and could benefit as a result of the foundation's grants. For example, the Bill & Melinda Gates Foundation held stock in Merck at a time when it developed partnerships with the African Comprehensive AIDS and Malaria Partnership and the Merck Company Foundation to test Merck products. As another instance, which may reflect aligning interests, the Robert Wood Johnson Foundation has played a leading role in promoting anti-tobacco products and maintains Smoking Cessation Leadership Centers and programs [72], although its endowment is mainly invested in Johnson & Johnson, a leading manufacturer of cessation products, and some board members have been represented on both the Foundation's and the company's boards [53].

(2) Transparency

Given that there is a limited pool of specialist expertise that can be drawn upon, it is possible that situations may arise where some persons who sit on the boards of, or advise, philanthropic foundations, will also have links to corporations. It would be unreasonable to demand that foundations refuse to engage with those who have corporate links, so denying themselves the best advice in some fields. Many authors have stated that a solution to this issue is to adopt full disclosure, or transparency, and to ensure that all individuals on foundation boards recuse themselves from decisions related to their affiliate companies [16]. However, achieving transparency and appropriate recusals is not always easy. Indeed, while the information we collected to conduct this case study is all in the public domain (and thus transparent), it required considerable time and effort to assemble in a manner that can be publicly interpreted, thus limiting full transparency. Furthermore, there is an inevitable time lag between decisions being made and information on the relationships among those making the decisions becoming available, which again limits transparency. Nevertheless this case study sets out the type of information that is required for observers to interpret global health financial flows and, we argue, offers a template for future disclosures to enhance transparency of not just individual employees but the full scope of potential conflicts of entire institutions.

(3) Aligning Aid with Community Needs

It is important to align aid with community needs. However, despite numerous declarations to align aid with the preventable burden of disease, private foundations tend to operate in “silos,” focused on a core set of issues that their founder or governing director decides is important [73]. Extra-budgetary contributions, earmarked by donors, are a major factor in creating the observed imbalance between patterns of expenditure by global health institutions and the current burden of disease [17].

Major funders can have a significant impact on overall financial flows; International Monetary Fund (IMF) economists are advising that countries divert aid to reserves because of concerns about its unreliable and unpredictable nature, and the desire to privatize health care services rather than perpetuate state-run health care operations [74],[75]. A recent study found that when countries are borrowing from the IMF more than 98% of aid is diverted to reserves or displacing government spending on health [75]. Working toward global health financing that aligns with the disease burden will remain elusive if foundations and financial institutions operate as distinct bodies while influencing communities that are receiving numerous disparate and poorly coordinated funds. Thus, foundation investment and program portfolios should incorporate representation from the intended recipients of its support.

Conclusion

The question of whether and how financial and institutional relationships might shape foundation decision-making has yet to be answered, and continues to be a point of controversy. To draw a recent example, if a Chinese businessperson invested in the Chinese auto industry were to donate to the Hurricane Katrina relief efforts in New Orleans, such a donation would no doubt be welcomed; if the donation, however, was conditional upon renovating New Orleans′ factories to produce products for the Chinese auto industry, such a program may produce legitimate debate. Analogously, when the Gates Foundation is heavily invested in Coca-Cola and simultaneously works to orient developing country farmers towards production for Coca-Cola instead of alternative development strategies, such an approach has potential consequences for grant-receiving communities and their health [21],[76]–[79].

Potential conflicts of interest exist everywhere, but there is considerable variation in how they are managed. When such topics have been discussed in the medical literature in the past, they have resulted in the avoidance of disastrous outcomes—such as the revelation that major biomedical research was inappropriately analyzed to support drug marketing by academics influenced by the pharmaceutical industry [80]. The overarching challenge is to prevent these potential interests from distorting science and public health outcomes.

Supporting Information

Zdroje

1. YachDFeldmanZABradleyDGKhanM

2010

Can the food industry help tackle the growing burden of

undernutrition?

Am J Public Health

100

974

980

2. RamptonSStauberJ

2010

Trust us, we're experts: How industry manipulates science

and gambles with your future.

Penguin

3. PintoSLipowskiESegalRKimberlinCAlginaJ

2007

Physicians' intent to comply with the American Medical

Association's guidelines on gifts from the pharmaceutical

industry.

J Med Ethics

33

313

319

4. SufrinCRossJS

2008

Pharmaceutical industry marketing: Understanding its impact on

women's health.

Obstet Gynecol Surv

63

585

596

5. BrownellKWarnerKE

2009

The perils of ignoring history: Big Tobacco played dirty and

millions died. How similar is Big Food?

Milbank Quarterly

87

259

294

6. WiistW

2010

The bottom line or public health: Tactics corporations use to

influence health and health policy, and what we can do to counter

them.

New York

Oxford University Press

7. Moss M (29 May 2010) The hard sell on salt. New York Times. Available:

http://www.nytimes.com/2010/05/30/health/30salt.html.

Accessed 10 March 2011

8. WedelJ

2001

Collision and Collusion: The strange case of Western aid to

Eastern Europe.

New York

St. Martin's

9. WestadO

2005

The global Cold War: Third world interventions and the making of

our times.

Cambridge

Cambridge University Press

10. EasterlyW

2006

The white man's burden.

Lancet

367

2060

11. MoyoD

2009

Dead aid: Why aid is not working and how there is another way for

Africa.

New York

Penguin

12. BenatarS

1998

Imperialism, research ethics and global health.

J Med Ethics

24

221

222

13. Global Health Watch

2009

Global Health Watch 2. London: Zed Books. Available: http://www.ghwatch.org/ghw2/report-summary. Accessed 10

March 2011

14. KleinN

2008

The shock doctrine: The rise of disaster

capitalism.

London

Penguin

15. ChangH

2009

Bad samaritans: The myth of free trade and the secret history of

capitalism.

Bloomsbury Publishing USA

16. SridharDBatnijiR

2008

Misfinancing global health: A case for transparency in

disbursements and decision making.

Lancet

372

1185

1191

17. StucklerDRobinsonHMcKeeMKingL

2008

World Health Organisation budget and burden of disease: A

comparative analysis.

Lancet

372

1563

1569

18. FaragMNandakumarAKWallackSSGaumerGHodgkinD

2009

Does funding from donors displace government spending for health

in developing countries?

Health Affairs

28

1045

1055

19. GarnerB

2009

Black's Law dictionary.

St Paul, MN

West Publishing

20. Wikipedia

2011

Conflict of interest. Wikipedia. Available: http://en.wikipedia.org/wiki/Conflict_of_interest. Accessed

10 March 2011

21. StuddertDMelloMMBrennanTA

2004

Financial conflicts of interest in physicians' relationships

with the pharmaceutical industry – Self regulation in the shadow of

federal prosecution.

New Eng J Med

351

1891

1900

22. BarnesDBeroLA

1996

Industry-funded research and conflict of interest: an analysis of

research sponsored by the tobacco industry through the Center for Indoor Air

Research.

J Health Polit Policy Law

21

515

542

23. World Health Organization. Roll Back Malaria Partnership: Conflict of

interest policy and procedure. Available: http://www.rbm.who.int/docs/constituencies/RBMcoiPolicy.pdf.

Accessed 10 March 2011

24. McCoyDKembhaviGPatelJLuintelA

2009

The Bill & Melinda Gates Foundation's grant-making

programme for global health.

Lancet

373

1645

1653

25. RavishankarNGubbinsPCooleyRJLeach-KemonKMichaudCMJamisonDTMurrayCJ

2009

Financing of global health: Tracking development assistance for

health from 1990 to 2007.

Lancet

373

2113

2124

26. OomsGStucklerDBasuSMcKeeM

2010

Financing the Millennium Development Goals for health and beyond:

Sustaining the 'Big Push'. Globalization and Health 6 : 17.

Available: http://www.globalizationandhealth.com/content/6/1/17.

Accessed 10 March 2011

27. McCoyDChandSSridharD

2009

Global health funding: How much, where it comes from and where it

goes.

Health Policy Plan

24

407

417

28. Abelson R (11 June 2000) Charities' Investing: Left hand, meet

right. New York Times. New York. Available: http://www.nytimes.com/2000/06/11/business/charities-investing-left-hand-meet-right.html.

Accessed 10 March 2011

29. Hilton Foundation

2011

Hilton in the community foundation: About us. Hilton Foundation.

Available: http://www.hilton-foundation.org.uk/about%20us.htm. Accessed

10 March 2011

30. WerbelJCarterSM

2002

The CEO's influence on corporate foundation

giving.

J Bus Ethics

40

47

60

31. DomhoffG

2009

The power elite and their challengers.

Am Behav Sci

52

955

973

32. BondMGlouharovaSHarriganN

2006

The effects of intercorporate networks on corporate social and

political behaviour: ESRC Final Report. Available: http://www.mysmu.edu/faculty/nharrigan/2006,%20ESRC%20Final%20Report.pdf.

Accessed 10 March 2011

33. MillsCWolfeA

2000

The power elite.

Oxford

Oxford University Press

34. DomhoffG

1967

Who rules America?

Englewood Cliffs, NJ

Prentice-Hall

35. DomhoffG

2009

How to do power structure research. University of California Santa

Cruz. Available: http://sociology.ucsc.edu/whorulesamerica/methods/how_to_do_power_structure_research.html.

Accessed 10 March 2011

36. NaderL

1972

Up the anthropologist – Perspectives gained from studying

up.

Rethinking anthropology. Pantheon Books

37. SmithD

2005

Institutional ethnography: A sociology for

people.

Oxford

AltaMira Press

38. MarcusG

1998

Ethnography through thick and thin.

Princeton, NJ

Princeton University Press

39. StoneD

2001

Policy paradox: The art of political

decision-making.

W W Norton & Co Inc

40. NyeJ

2004

Soft power.

Foreign Policy

80

153

171

41. LukesS

1974

Power: A radical view.

London

Macmillan Press

42. FoucaultMGordonC

1980

Power/knowledge: Selected interviews and other writings,

1972–1977: Pantheon

43. BuffettW

2010

My philanthropic pledge. Forbes. Available: http://money.cnn.com/2010/06/15/news/newsmakers/Warren_Buffett_Pledge_Letter.fortune/.

Accessed 10 March 2011

44. Securities and Exchange Commission

2010

Edgar database. Bill & Melinda Gates Foundation Trust filings.

Available: http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001166559&owner=exclude&count=40.

Accessed 10 March 2011

45. Bill & Melinda Gates Foundation Trust

2009

Return of Private Foundation. Form 990-PF. Department of the Treasury,

Internal Revenue Service. Available: http://nccsdataweb.urban.org/PubApps/showOrgsByCategory.php?group=pf.

Accessed 10 March 2011

46. HodgsonJ

2009

Gates Foundation sells off pharmaceutical holdings. New York: Wall

Street Journal. Available: http://online.wsj.com/article/SB125029373754433433.html.

Accessed 10 March 2011

47. MarketWatch (22 April 2010) As American as whole-grain chips: PepsiCo

tries to appeal to our better angels. Available: http://www.marketwatch.com/story/pepsico-appeals-to-our-better-angels-2010-04-22.

Accessed 10 March 2011

48. CNBC (1 July 2010) Warren Buffett's $1.6 billion stock

donation to Gates Foundation lifts 5-Year total to $8 billion.

Available: http://www.cnbc.com/id/38046115/Warren_Buffett_s_1_6_Billion_Stock_Donation_to_Gates_Foundation_Lifts_5_Year_Total_to_8_Billion.

Accessed 10 March 2011

49. National Center for Charitable Statistics

2011

NCCS P990 Internal Revenue Service Database: Urban Institute. http://nccsdataweb.urban.org/PubApps/990search.php/.

Accessed 10 March 2011

50. Ford Foundation

2009

Return of Private Foundation. Form 990-PF: Department of the Treasury,

Internal Revenue Service. Available: http://nccsdataweb.urban.org/PubApps/showOrgsByCategory.php?group=pf.

Accessed 10 March 2011

51. Rockefeller Foundation

2009

Return of Private Foundation. Form 990-PF: Department of the

Treasury, Internal Revenue Service.

52. W. K. Kellogg Foundation

2009

Return of Private Foundation. Form 990-PF: Department of the Treasury,

Internal Revenue Service. Available: http://nccsdataweb.urban.org/PubApps/showOrgsByCategory.php?group=pf.

Accessed 10 March 2011

53. Robert Wood Johnson Foundation

2009

Return of private foundation. Form I990-PF: Department of the Treasury,

Internal Revenue Service. Available: http://nccsdataweb.urban.org/PubApps/showOrgsByCategory.php?group=pf.

Accessed 10 March 2011

54. Rockefeller Foundation

2011

Social investment guidelines. New York: Rockefeller Foundation.

Available: http://www.rockefellerfoundation.org/uploads/files/af34dcb4-1000-4dde-9748-df58eafc7ae2.pdf.

Accessed 10 March 2011

55. Bill & Melinda Gates Foundation

2010

Conflict of interest policy. Available: http://www.gatesfoundation.org/about/Documents/Conflict_of_Interest_Policy.pdf.

Accessed 10 March 2011

56. Ford Foundation

2011

Mission: Ford Foundation. Available: http://www.fordfoundation.org/about-us/mission. Accessed 10

March 2011

57. Rockefeller Foundation

2011

Moments in time: 1913-1919. Rockefeller Foundation. Available:

http://www.rockefellerfoundation.org/who-we-are/our-history/1913-1919/.

Accessed 10 March 2011

58. GatesB

2010

2010 Annual letter from Bill Gates. Available: http://www.gatesfoundation.org/annual-letter/2010/Pages/bill-gates-annual-letter.aspx.

Accessed 10 March 2011

59. Bill & Melinda Gates Foundation

2011

Kate James, Chief Communication Officer Foundation Operations. Bill

& Melinda Gates Foundation. Available: http://www.gatesfoundation.org/leadership/Pages/kate-james.aspx.

Accessed 10 March 2011

60. Bill & Melinda Gates Foundation

2011

Tachi Yamada, President Global Health Program: Bill & Melinda Gates

Foundation. Available: http://www.gatesfoundation.org/leadership/Pages/tachi-yamada.aspx.

Accessed 10 March 2011

61. Reuters (31 March 2010) Merck exec to be Gates Foundation CFO. Reuters.

Seattle. Available: http://www.reuters.com/article/idUSN3120892820100331.

Accessed 10 March 2011

62. Bill & Melinda Gates Foundation

2011

United States program advisory panel: Anne Fudge. Bill & Melinda

Gates Foundation. Available: http://www.gatesfoundation.org/united-states/Pages/program-advisory-panel.aspx.

Accessed 10 March 2011

63. Bill & Melinda Gates Foundation

2010

The Coca-Cola Company, TechnoServe and The Gates Foundation partner to

boost incomes of 50K small-scale farmers in East Africa. Available:

http://www.gatesfoundation.org/press-releases/Pages/technoserv-empowers-farmers-in-uganda-and-kenya-100120.aspx.

Accessed 10 March 2011

64. GatesM

2010

What we can learn from Coke. TEDxChange. Available: http://www.gatesfoundation.org/tedxchange/Pages/tedxchange-2010.aspx.

Accessed 10 March 2011

65. Johnson & Johnson Foundation

2009

Novel partnerships evolve drug development. Our Responsibility. 2009

Sustainability Report. Available: http://www.investor.jnj.com/2009sustainabilityreport/society/partnerships2.html.

Accessed 10 March 2011

66. EbrahimSSmithGD

2001

Exporting failure? Coronary heart disease and stroke in

developing countries.

Int J Epidemiol

30

201

205

67. World Health Organization

2009

Mortality and burden of disease estimates for WHO Member States

in 2004.

Geneva

World Health Organization

68. SuhrckeMNugentRStucklerDRoccoL

2006

Chronic disease: An economic perspective.

London

Oxford Health Alliance

69. MontagueDFeachemRFeachemNSKoehlmoosTPKinlawH

2009

Oxfam must shed its ideological bias to be taken

seriously.

BMJ

338

b1202

70. PillerCSandersEDixonR

7 January 2007

Dark cloud over good works of Gates Foundation. Los Angeles Times.

Available: http://www.latimes.com/news/la-na-gatesx07jan07,0,2533850.story.

Accessed 10 March 2011

71. Bibbins-DomingoKChertowGMCoxsonPGMoranALightwoodJM

2010

Projected effect of dietary salt reductions on future

cardiovascular disease.

New Engl J Med

362

590

599

72. Robert Wood Johnson Foundation

2010

More than a decade of helping smokers quit: The Robert Wood Johnson

Foundation's Investment in Tobacco Cessation. Appendix 1: Major

Tobacco-Cessation Grants of the Robert Wood Johnson Foundation. Robert Wood

Johnson Foundation. Available: http://www.rwjf.org/pr/product.jsp?id=63799. Accessed 10

March 2011

73. McNeilD

16 February 2008

Gates Foundation's influence criticized. New York Times.

Available: http://www.nytimes.com/2008/02/16/science/16malaria.html?_r=3&ref=health&oref=slogin&oref=login.

Accessed 10 March 2011

74. OomsGHammondR

2009

Scaling up global social health protection: Prerequisite reforms

to the International Monetary Fund.

Int J Health Serv

39

795

801

75. StucklerDBasuSMcKeeM

2011

International Monetary Fund and aid displacement.

Int J Health Services

41

67

76

76. RutledgePCrookesDMcKinstryBMaxwellSR

2003

Do doctors rely on pharmaceutical industry funding to attend

conferences and do they perceive that this creates a bias in their drug

selection? Results from a questionnaire survey.

Pharmacoepidemiol Drug Saf

12

663

667

77. WazanaA

2000

Physicians and the pharmaceutical industry: Is a gift ever just a

gift?

JAMA

283

373

380

78. LexchinJ

1993

Interactions between physicians and the pharmaceutical industry:

What does the literature say?

CMAJ

149

1401

1407

79. SpurlingGKMansfieldPRMontgomeryBDLexchinJDoustJ

2010

Information from pharmaceutical companies and the quality,

quantity, and cost of physicians' prescribing: A systematic

review.

PLoS Med

7

e1000352

doi:10.1371/journal.pmed.1000352

80. SingerN

4 August 2009

Medical papers by ghostwriters pushed therapy. New York Times.

Available: http://www.nytimes.com/2009/08/05/health/research/05ghost.html.

Accessed 10 March 2011

81. WiistB

2010

The corporate playbook, health, and democracy: the snack food and

beverage industry's tactics in context. Ch 6

StucklerDSiegelK

Sick Societies: Responding to the Global Challenge of Chronic

Disease. Oxford University Press. In press

Štítky

Interní lékařství

Článek vyšel v časopisePLOS Medicine

Nejčtenější tento týden

2011 Číslo 4- Berberin: přírodní hypolipidemikum se slibnými výsledky

- Superoxidované roztoky v prevenci infekcí u dialyzovaných pacientů

- Léčba bolesti u seniorů

- Benefity fixní kombinace tramadolu a paracetamolu v léčbě bolesti

- Flexofytol® – přírodní revoluce v boji proti osteoartróze kloubů

-

Všechny články tohoto čísla

- Quality of Private and Public Ambulatory Health Care in Low and Middle Income Countries: Systematic Review of Comparative Studies

- A Multifaceted Intervention to Implement Guidelines and Improve Admission Paediatric Care in Kenyan District Hospitals: A Cluster Randomised Trial

- The Quality of Medical Care in Low-Income Countries: From Providers to Markets

- Neglect of Medical Evidence of Torture in Guantánamo Bay: A Case Series

- Improving Effective Surgical Delivery in Humanitarian Disasters: Lessons from Haiti

- Decline in Diarrhea Mortality and Admissions after Routine Childhood Rotavirus Immunization in Brazil: A Time-Series Analysis

- Effect of Pneumococcal Conjugate Vaccination on Serotype-Specific Carriage and Invasive Disease in England: A Cross-Sectional Study

- Effect of a Nutrition Supplement and Physical Activity Program on Pneumonia and Walking Capacity in Chilean Older People: A Factorial Cluster Randomized Trial

- Strategies and Practices in Off-Label Marketing of Pharmaceuticals: A Retrospective Analysis of Whistleblower Complaints

- A Call for Action: The Application of the International Health Regulations to the Global Threat of Antimicrobial Resistance

- Medical Complicity in Torture at Guantánamo Bay: Evidence Is the First Step Toward Justice

- A Public Health Emergency of International Concern? Response to a Proposal to Apply the International Health Regulations to Antimicrobial Resistance

- Global Health Philanthropy and Institutional Relationships: How Should Conflicts of Interest Be Addressed?

- Claims about the Misuse of Insecticide-Treated Mosquito Nets: Are These Evidence-Based?

- The African Women's Protocol: Bringing Attention to Reproductive Rights and the MDGs

- PLOS Medicine

- Archiv čísel

- Aktuální číslo

- Informace o časopisu

Nejčtenější v tomto čísle- Global Health Philanthropy and Institutional Relationships: How Should Conflicts of Interest Be Addressed?

- A Call for Action: The Application of the International Health Regulations to the Global Threat of Antimicrobial Resistance

- Claims about the Misuse of Insecticide-Treated Mosquito Nets: Are These Evidence-Based?

- Neglect of Medical Evidence of Torture in Guantánamo Bay: A Case Series

Kurzy

Zvyšte si kvalifikaci online z pohodlí domova

Současné možnosti léčby obezity

nový kurzAutoři: MUDr. Martin Hrubý

Všechny kurzyPřihlášení#ADS_BOTTOM_SCRIPTS#Zapomenuté hesloZadejte e-mailovou adresu, se kterou jste vytvářel(a) účet, budou Vám na ni zaslány informace k nastavení nového hesla.

- Vzdělávání